Financial Services

Robust risk indicators at your fingertips that help minimise your exposure.

Manage risks better

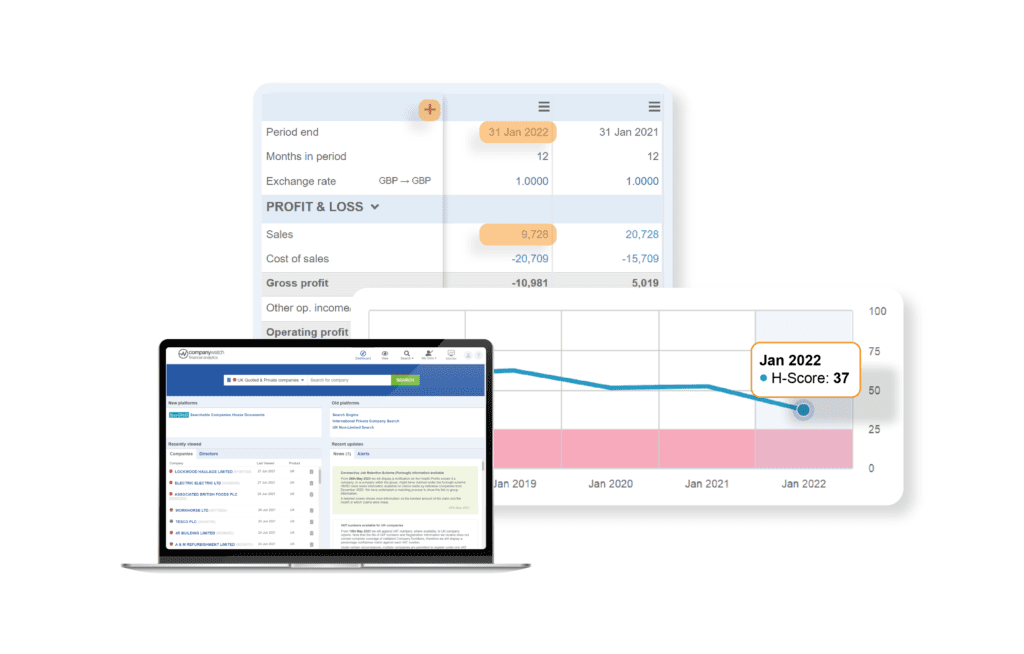

Use the power of H-Score®, PoD® and TextScore® to give you unbeatable forward-looking insights and in-depth analysis to help you make better decisions.

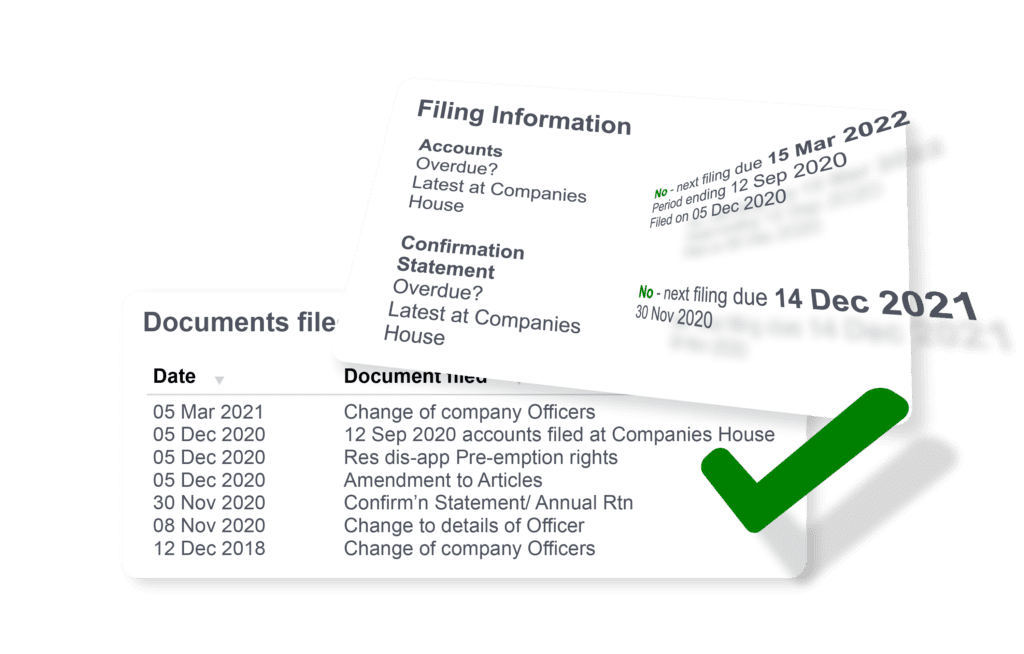

Minimise fraud

Protect yourself against fraud and money laundering by really Knowing Your Customer.

Check filing dates and name changes held at Companies House and uncover individual directorships which are not linked by Companies House, using our advanced director matching algorithm, Aphrodite®.

Use automation

Speed up processes using automation especially for onboarding. Use API connections to automate internal workflows and make the customer journey smoother by pre-populating information, and segmenting according to a rules-based scorecard.

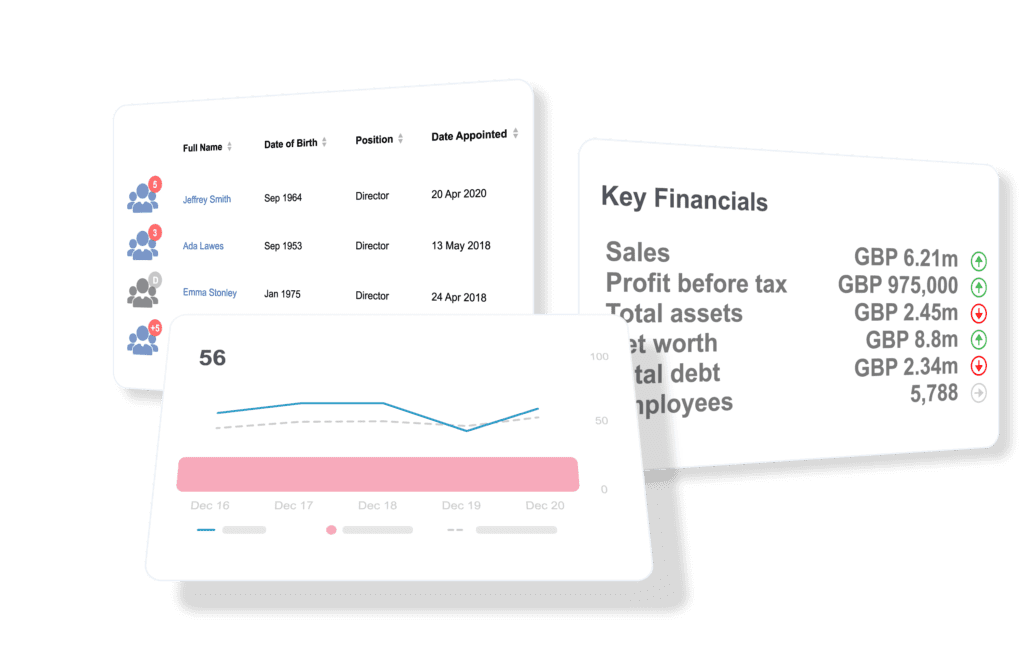

Assess from multiple angles

Drill down on critical risks for detailed information and assess risks from multiple angles before making an informed decision.

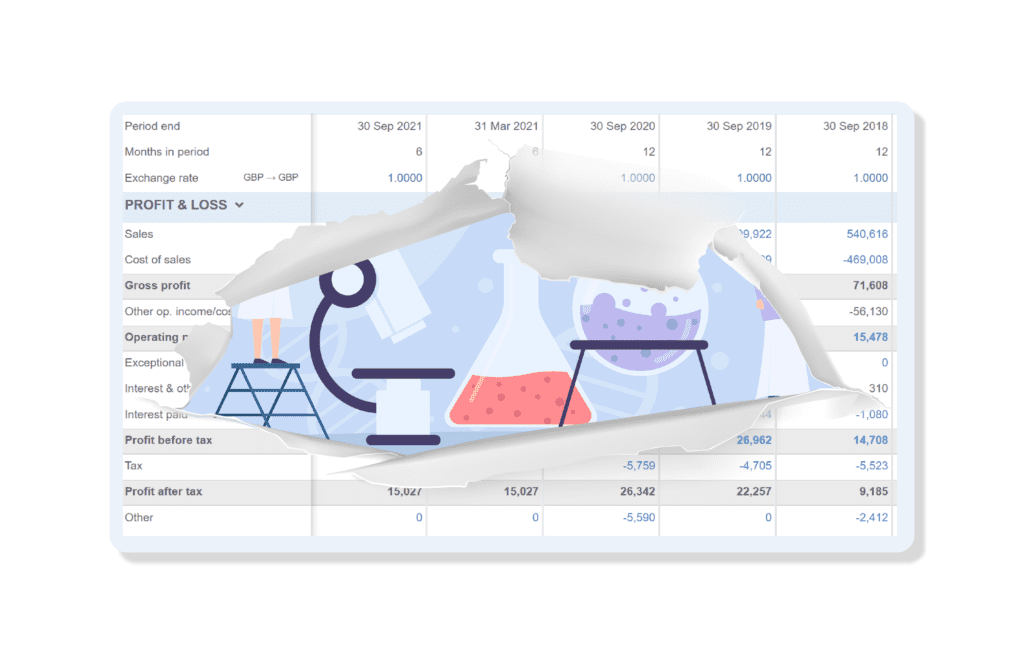

Stress-test marginal cases

Use the Experiments tool to produce a ‘what if’ scenario and make an evidence-based decision on marginal lending cases.

Our Service

We help our clients manage their strategic business relationships, giving them scores that look at a medium-term forecast, and the tools to allow them to look even further into the future.

Explainable

We provide ‘white box’ scores, which allow you to make evidence-based decisions and justify these to key stakeholders in your organisation.

Interactive

Being able to model scenarios and understand ever-changing risk has never been more important. We give you the tools to do that.

Time-Saving

With tools like Aphrodite®, SearCHeD, TextScore® and our Furlough data matching, we allow you to investigate risks thoroughly in minutes.

Why choose Company Watch?

As a financial analytics company, our risk analysis and data modelling platform provides intelligent and actionable insights, giving you an unbeatable edge when it comes to managing risk.

Unlike a traditional credit reference agency, we have the ability to map medium to long-term risk as well as short-term risk. As a result, you can accurately predict financial risks before they become financial losses.

Arrange a trial

Discover how Company Watch can help you minimise your risk by using financial analytics to accurately predict company failures.