Banking

Monitor company performance and compliance and manage risk with up-to-date accurate information.

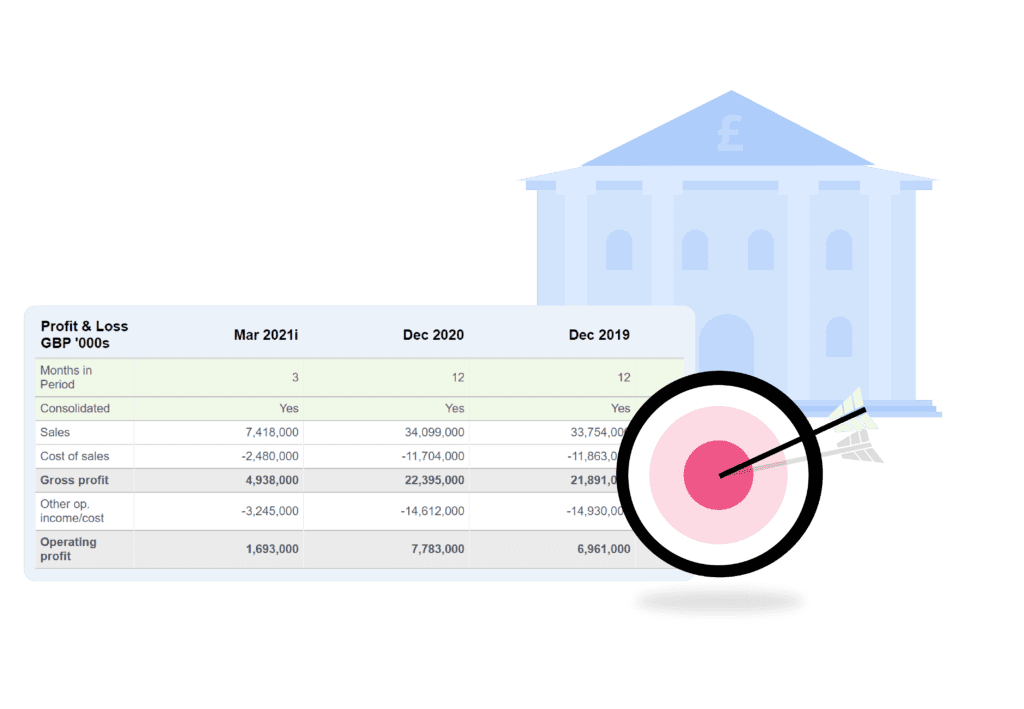

Make better lending decisions

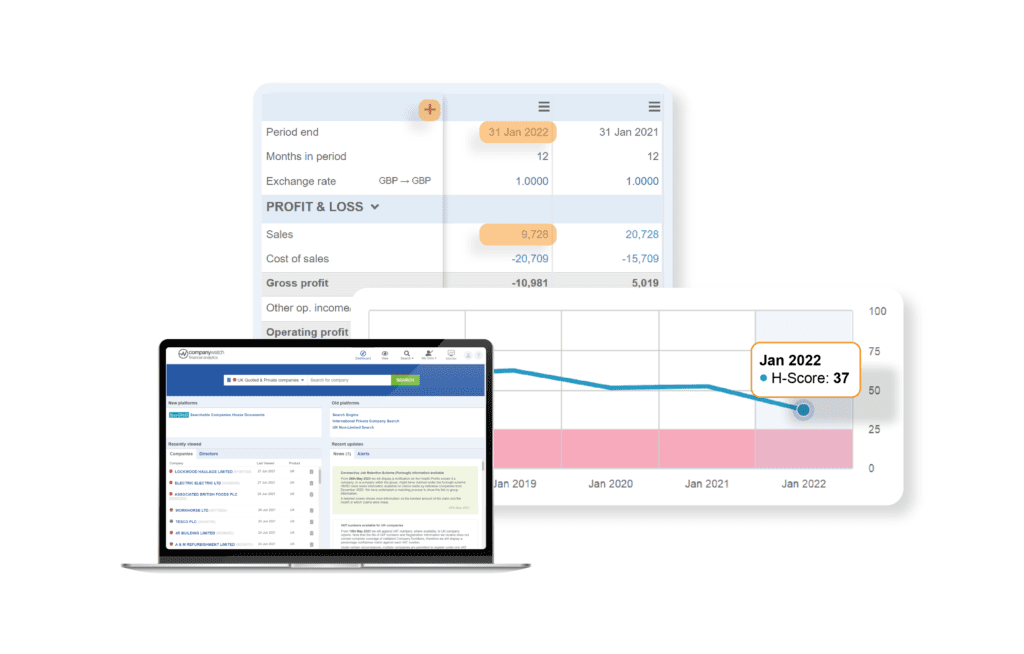

Our suite of scores, including the H-Score® and TextScore® along with our director-matching algorithm Aphrodite®, have been designed to help our clients discover and manage the risks associated with lending to individual companies.

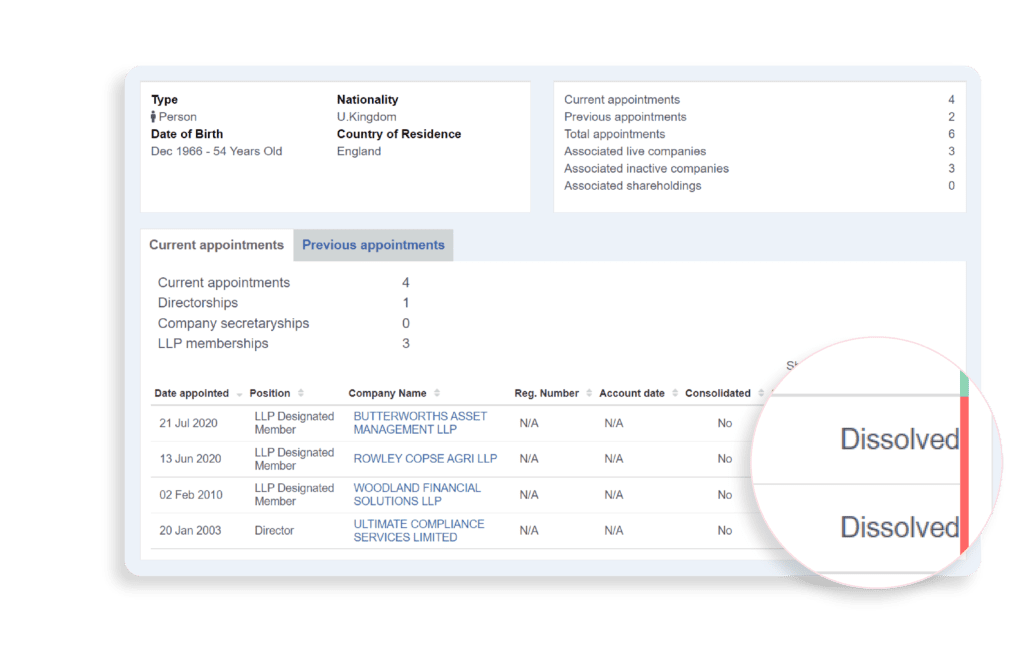

Carry out due diligence

Aphrodite® allows you to trace hidden director links and our range of company information makes it easy to find out about group company and ownership connections.

Our VAT and Furlough data also traces how companies might be connected in ways that the basic information from Companies House won’t show.

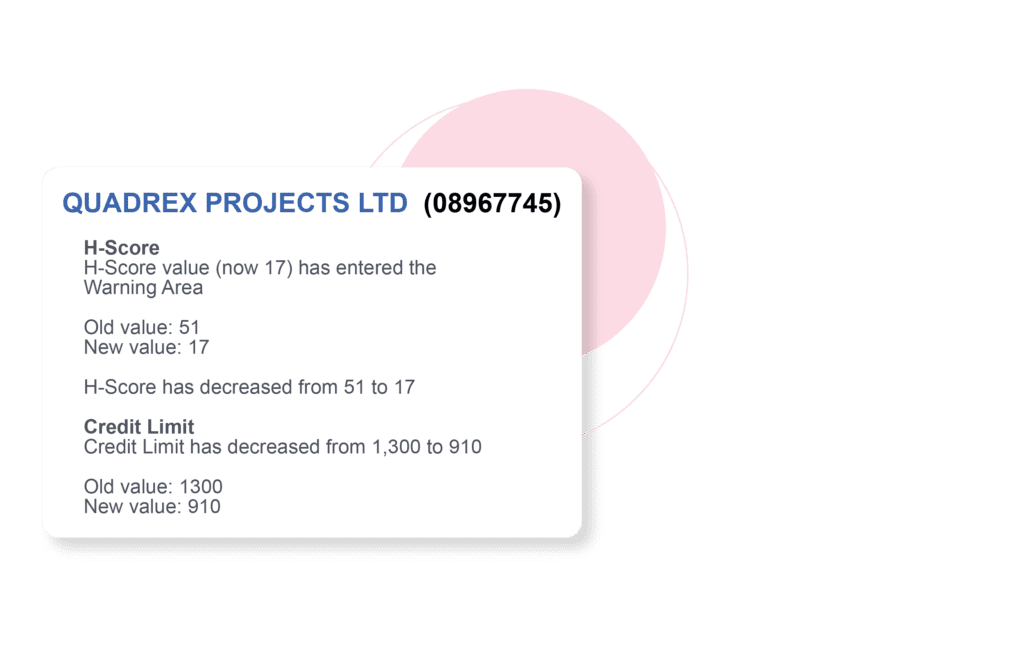

Manage portfolio risk

Easily manage and track companies across your wider portfolio with our Monitoring tool. This automatically alerts you of any changes to a company’s H-Score®, filings at Companies House, profit warnings and much more. Alerts are customisable for each Portfolio.

Use automation

Speed up processes using automation. This can be especially useful for customer onboarding where our API links can allow you to create a seamless customer journey.

Stress-test marginal lending

Use the Experiments tool to produce a ‘what if’ scenario and make an evidence-based decision on marginal lending cases.

Our Service

We help our clients manage their strategic business relationships, giving them scores that look at a medium-term forecast, and the tools to allow them to look even further into the future.

Explainable

We provide ‘white box’ scores, which allow you to make evidence-based decisions and justify these to key stakeholders in your organisation.

Interactive

Being able to model scenarios and understand ever-changing risk has never been more important. We give you the tools to do that.

Time-Saving

With tools like Aphrodite®, SearCHeD, TextScore® and our Furlough data matching, we allow you to investigate risks thoroughly in minutes.

Why choose Company Watch?

As a financial analytics company, our risk analysis and data modelling platform provides intelligent and actionable insights, giving you an unbeatable edge when it comes to managing risk.

Unlike a traditional credit reference agency, we have the ability to map medium to long-term risk as well as short-term risk. As a result, you can accurately predict financial risks before they become financial losses.

Arrange a trial

Discover how Company Watch can help you minimise your risk by using financial analytics to accurately predict company failures.