Enhanced Due Diligence & AML

Carry out enhanced due diligence and maintain your reputation and integrity with our comprehensive range of services.

Our in-depth EDD reports enable you to meet AML requirements and manage your exposure to risk with ease.

Google searches only cover around 4-6% of the entire internet. We analyse and gather data across a vast array of resources, including deep and dark web, so you can conduct business with confidence.

Know your customer… or supplier

Financial failure is one of the biggest threats to a business, it’s important to know the financial health of your key customers and suppliers.

Carry out due diligence on your customers and suppliers and protect your business against money laundering and fraud. Our EDD reports clearly set out risks with detailed evidence, audit trails, and a list of all sources used.

EDD reports you can trust

Our Enhanced Due Diligence reports empower businesses to navigate complex landscapes with confidence.

We comb through over 198m corporate records and 600bn+ archived web resources so you can be sure no stone has been left unturned.

Discover the power of comprehensive insights and make well-informed decisions with our tailored EDD reports.

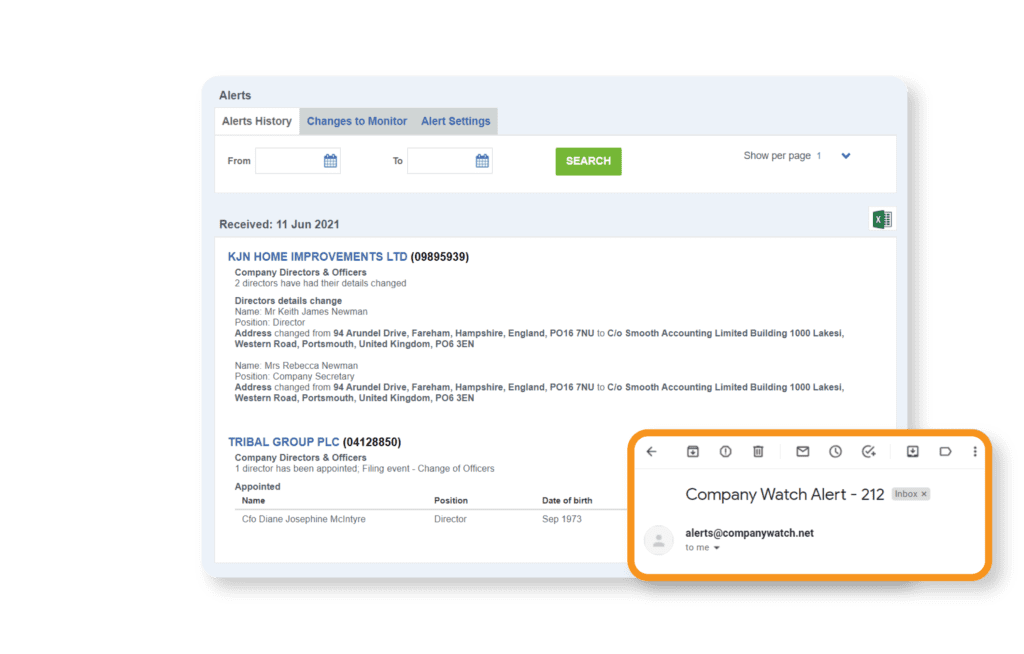

Ongoing monitoring

Customers’ and suppliers’ circumstances change frequently, so a past check may not reflect their status now.

Our daily monitoring service ensures you continue to be compliant with the Anti-Money Laundering directive.

PEPs and Sanctions

By identifying a PEP, your company can manage a potentially substantial legal and reputational risk.

With a 30-40% increase every year in the PEPs list alone, it’s vital to screen new and existing clients to make sure they’re compliant with AML guidelines.

Our PEPs and Sanction API allows you to perform second-stage extended due diligence. This means you can incorporate it into your KYC processes so that individuals and organisations are automatically flagged up as high risk.

Manage compliance your way

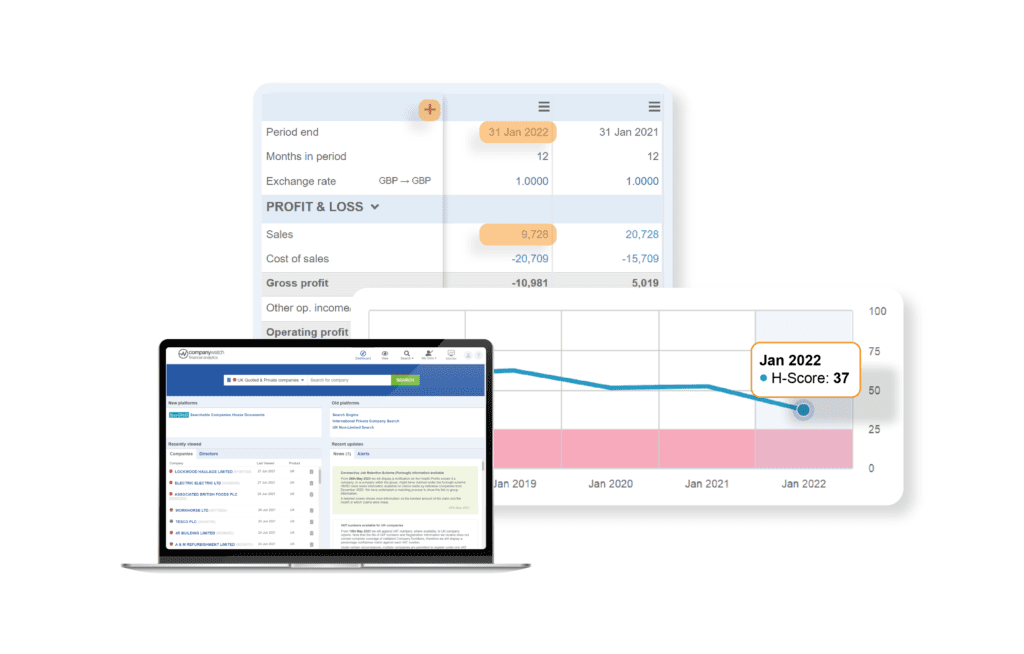

Accurate, consistent and trustworthy information for people who need to understand the financial risks of doing business. Explore the different ways in which you can access our analytics.

Why Company Watch?

Our financial risk solutions provide intelligent and actionable insights, giving you an unbeatable edge when it comes to financial risk management.

Unlike other providers, we have the ability to map medium to long-term risk as well as short-term risk. As a result, you can accurately predict financial risks before they become financial losses.

Our Service

We help our clients manage their exposure to financial risk, giving them scores that look at a medium-term forecast, and the tools to allow them to look even further into the future.

Explainable

We provide ‘white box’ scores, which allow you to make evidence-based decisions and justify these to key stakeholders in your organisation.

Interactive

Being able to model scenarios and understand ever-changing risk has never been more important. We give you the tools to do that.

Time-Saving

With tools like our Director Matching and SearCHeD, we speed up your current risk management process and allow you to investigate risks in minutes.

Frequently asked questions

Enhanced due diligence involves investigating and evaluating a company or individual before entering into a business transaction. It involves the gathering of information to assess the level of risk involved and to ensure compliance with current legal and regulatory requirements.

Commercial due diligence refers to a series of checks that need to be carried out before you go into business with a company. It is usually performed by a third party consultant as part of a wider due diligence process.

Due diligence is actually required by law in certain industries such as Gambling, Cryptocurrency, Real estate, Legal, Insurance, and more.

It is critical for companies to identify any potential risks, such as fraud, corruption, or money laundering to guard against financial loss or reputational damage.

Here’s 3 common mistakes you can avoid with enhanced due diligence checks.

Enhanced due diligence is an Anti-Money Laundering (AML) process, required when business partnerships need a higher level of scrutiny. As fraud and money laundering rise in the UK, the government has tightened regulations. Here are some examples of when you’ll be required to conduct EDD:

- Entities are from high-risk third countries

- Entities are Politically Exposed Persons

- Transactions involve high-risk industries

- Entities include high-net-worth individuals with complex business structures

- Entities have a history of criminal activity

- Businesses with significant cash transactions

Advancing technology is making it increasingly difficult to uncover risks hidden deep on the internet. With global fines for AML non-compliance increasing year on year, it can feel overwhelming. Our EDD reports are here to help.

Anti-money laundering (AML) is a set of laws, regulations, and processes designed to prevent criminals from hiding illegally acquired funds as legitimate income. It involves identifying and reporting suspicious activities, such as money laundering or terrorist financing.

The key components of AML include customer due diligence, transaction monitoring, suspicious activity reporting and record-keeping.

Read why an enhanced due diligence report and AML check is worth its weight in gold.

The consequences of non-compliance with AML regulations can include fines, legal action, loss of license or registration, and reputational damage. In some cases, it can also lead to criminal charges for individuals involved in money laundering or other illegal activities.

A politically exposed person (PEP) is an individual who holds a prominent public function.

A PEP typically presents a higher risk for potential involvement in bribery and corruption due to the nature of their position and the influence they may have.

Company Watch model for determining PEPs:

Tier 1 – Foreign PEPs:

- Heads of governments

- Royal families

- Executives of state-owned corporations

- Various politicians

- Senior military or judicial officials

Tier 2 – Domestic PEPs:

- Head of government

- Royal family members

- Executives of state-owned corporations

- Various politicians

- Senior military or judicial officials

- Mayors of major cities

- Senior members of mainstream religious groups

Tier 3 – Low Priority:

- Board members

- Upper-level management

- C-suites

- Directors

- Trade union heads

- Senior civil servants

Tier 4 – PEP by Association:

- Family members including in-laws

- Business partners and associates

- Public known associates of previous tiers

With governments worldwide tightening regulations in response to the rise in bribery and corruption, having access to up-to-date Politically Exposed Persons (PEPs) and Sanctions data is critical. Get in touch today to see how Company Watch can help you meet AML requirements.

Arrange a trial

Discover how Company Watch can help you minimise your risk by using financial analytics to accurately predict company failures.